Unlocking Entrepreneurial Potential: A Comprehensive Guide to Venture Capital and Private Equity Financing

The world of entrepreneurship is a dynamic landscape, fueled by the unwavering determination of individuals with innovative ideas. However, turning those ideas into thriving businesses requires more than just passion and ambition. Access to capital is often the catalyst that transforms a startup's potential into tangible success.

4.6 out of 5

| Language | : | English |

| File size | : | 8157 KB |

| Screen Reader | : | Supported |

| Print length | : | 464 pages |

| X-Ray for textbooks | : | Enabled |

Enter venture capital and private equity, two critical pillars of entrepreneurial financing that have played a pivotal role in fostering innovation and creating countless success stories. This comprehensive guide will delve into the intricate world of venture capital and private equity, providing entrepreneurs with an in-depth understanding of how these financing mechanisms can unlock their entrepreneurial potential.

Chapter 1: Demystifying Venture Capital and Private Equity

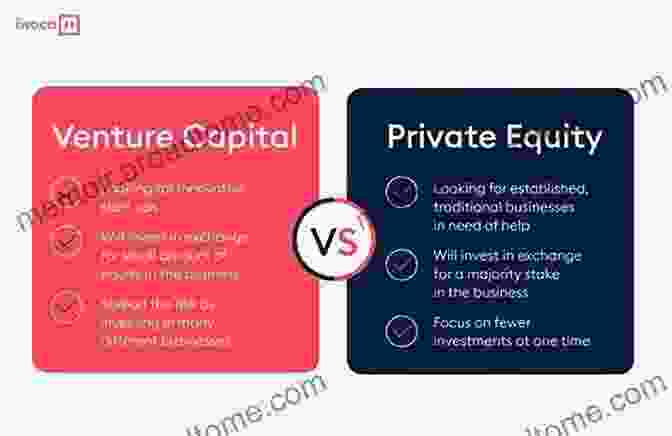

What is Venture Capital?

Venture capital is a type of financing provided to early-stage companies with high growth potential. Venture capitalists (VCs) typically invest in companies that have the capacity to scale rapidly and generate substantial returns for investors.

What is Private Equity?

In contrast to venture capital, private equity focuses on investing in more mature businesses that have a track record of profitability. Private equity firms often acquire controlling stakes in companies to drive growth, improve operations, and ultimately increase the value of the investment.

Chapter 2: The Role of Venture Capital in Entrepreneurship

Venture capital plays a transformative role in the early stages of a company's life cycle. It provides essential funding for companies to:

- Develop and commercialize innovative products and services

- Hire a talented workforce

- Expand into new markets

- Acquire other companies

In return for their investment, VCs typically receive equity in the company and take an active role in supporting its growth. This includes providing mentorship, strategic guidance, and access to valuable networks.

Chapter 3: The Private Equity Landscape

Private equity encompasses a wide range of investment strategies, including:

- Buyouts: Acquiring controlling stakes in mature companies

- Growth equity: Investing in companies with high growth potential

- Distressed debt: Investing in the debt of companies experiencing financial distress

- Venture capital: Providing funding to early-stage companies

Private equity funds typically have a longer investment horizon than venture capital funds and focus on generating returns through a combination of capital appreciation and dividend income.

Chapter 4: Financing Options for Entrepreneurs

Entrepreneurs have various options for obtaining venture capital and private equity financing. These include:

- Angel investors: Wealthy individuals who invest in early-stage companies

- Venture capital funds: Professional investment firms that manage funds dedicated to venture capital investments

- Private equity firms: Investment firms focused on acquiring controlling stakes in mature companies

- Corporate venture capital: Venture capital subsidiaries of large corporations

The choice of funding option depends on the stage of the company, its financing needs, and the entrepreneur's investment preferences.

Chapter 5: The Due Diligence Process

Before investing, venture capitalists and private equity firms conduct a thorough due diligence process to assess the risks and potential rewards of an investment. This process typically includes:

- Financial analysis

- Market research

- Operational review

- Legal and regulatory compliance

- Management assessment

Due diligence is essential to mitigate investment risks and increase the likelihood of success.

Chapter 6: Exit Strategies

The ultimate goal of venture capitalists and private equity investors is to achieve a profitable exit from their investment. Common exit strategies include:

- Initial public offering (IPO): Selling shares of the company to the public on a stock exchange

- Mergers and acquisitions: Selling the company to another company for cash or stock

- Secondary sale: Selling the company or a portion of its shares to another investor

- Liquidation: Distributing the company's assets to shareholders

The choice of exit strategy depends on the company's financial performance, market conditions, and investor preferences.

Venture capital and private equity play a vital role in the success of entrepreneurship. They provide essential financing, strategic support, and access to networks that can propel startups to new heights.

By understanding the intricacies of venture capital and private equity, entrepreneurs can increase their chances of securing the funding they need to turn their innovative ideas into thriving businesses and, ultimately, drive economic growth and innovation.

4.6 out of 5

| Language | : | English |

| File size | : | 8157 KB |

| Screen Reader | : | Supported |

| Print length | : | 464 pages |

| X-Ray for textbooks | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Pam Perry

Pam Perry John Wimber

John Wimber Brooke Goldner

Brooke Goldner Daniel Weiniger

Daniel Weiniger Scott Wise

Scott Wise Peter Masters

Peter Masters Preston Gralla

Preston Gralla Tiffany Manbodh

Tiffany Manbodh Marcel Moring

Marcel Moring Jamilla Okubo

Jamilla Okubo Gita Joshi

Gita Joshi Humberto De Souza

Humberto De Souza David Hornsby

David Hornsby Michael Gordon

Michael Gordon Hiroyuki Sasabe

Hiroyuki Sasabe Kamel Daoud

Kamel Daoud Francis X Ryan Cpa Cgma Mba

Francis X Ryan Cpa Cgma Mba Alessandra Lemma

Alessandra Lemma Kate Bornstein

Kate Bornstein Sophie Mills

Sophie Mills

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Simon MitchellHow Policies and Practices Shape Children's Opportunities: Apa Bronfenbrenner...

Simon MitchellHow Policies and Practices Shape Children's Opportunities: Apa Bronfenbrenner...

Geoffrey BlairUnlocking the Future of Energy: Reprocessing and Recycling of Spent Nuclear...

Geoffrey BlairUnlocking the Future of Energy: Reprocessing and Recycling of Spent Nuclear... Jacques BellFollow ·6.7k

Jacques BellFollow ·6.7k Cody BlairFollow ·8k

Cody BlairFollow ·8k Rob FosterFollow ·13.3k

Rob FosterFollow ·13.3k Leo TolstoyFollow ·13.3k

Leo TolstoyFollow ·13.3k T.S. EliotFollow ·2.7k

T.S. EliotFollow ·2.7k Deacon BellFollow ·19.6k

Deacon BellFollow ·19.6k Ashton ReedFollow ·13.3k

Ashton ReedFollow ·13.3k Emanuel BellFollow ·2.4k

Emanuel BellFollow ·2.4k

Henry Green

Henry GreenCorrosion and Its Consequences for Reinforced Concrete...

Corrosion is a major threat to reinforced...

James Gray

James GrayDiscover the Enigmatic World of Pascin in "Pascin Mega...

Immerse Yourself in the...

George R.R. Martin

George R.R. MartinUnlocking the Power of Nature: Delve into the Bioactive...

In a world increasingly...

Julian Powell

Julian PowellMaster the Art of Apple Watch App Development: A...

Unlock the Potential of Apple Watch Apps In...

Jaylen Mitchell

Jaylen MitchellPlastic Optical Fiber Sensors: A Comprehensive Guide to...

In the rapidly evolving landscape of...

Truman Capote

Truman CapoteUnlock the Secrets of Language Creation: Dive into...

The realm of computer science...

4.6 out of 5

| Language | : | English |

| File size | : | 8157 KB |

| Screen Reader | : | Supported |

| Print length | : | 464 pages |

| X-Ray for textbooks | : | Enabled |