Unlock the Secrets to Free Income Tax Returns: A Comprehensive Guide

It's 2024, and you're facing the daunting task of filing your income taxes. But what if I told you there was a way to skip paying those taxes altogether? Believe it or not, it's possible to earn free returns on your income taxes for life, starting from this tax season.

In this comprehensive guide, we'll delve into the world of tax loopholes and strategies that will empower you to save thousands of dollars on your tax bills. Get ready to discover the hidden paths to financial freedom and a stress-free tax season.

4.4 out of 5

| Language | : | English |

| File size | : | 1430 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 29 pages |

| Lending | : | Enabled |

Understanding the Tax System: A Primer

Before we dive into the specifics, it's essential to have a basic understanding of the tax system. Taxes are imposed by the government on individuals and businesses to generate revenue for public services. In the context of personal income taxes, you're obligated to report your annual earnings and pay a percentage of those earnings to the government.

However, the tax code is filled with deductions, credits, and exemptions that can significantly reduce your tax liability. These provisions are designed to incentivize certain behaviors, provide relief to specific groups of taxpayers, and ensure fairness in the tax system.

The Magic of Tax Loophole

Tax loopholes are legal methods of reducing your tax bill without violating any laws. These loopholes are created by the complexity of the tax code, which often contains ambiguous or overlapping provisions. By carefully analyzing the tax code and understanding how it interacts with your financial situation, you can identify opportunities to minimize your tax liability.

Strategies for Free Income Tax Returns

Now, let's dive into the specific strategies that will help you earn free income tax returns starting from 2024 tax season:

1. Maximize Tax-Deductible Contributions:

One of the most effective ways to reduce your taxable income is to make tax-deductible contributions. These contributions can be to retirement accounts, charitable organizations, or certain other expenses specified in the tax code.

- Retirement Accounts: Contributions to traditional IRAs and 401(k) plans are tax-deductible, meaning you can lower your current year's taxable income by the amount you contribute.

- Charitable Donations: Donations to qualified charities are also tax-deductible, providing an opportunity to reduce your tax liability while supporting causes that you care about.

2. Utilize Tax Credits:

Unlike deductions, which reduce your taxable income, tax credits directly lower your tax bill. There are various types of tax credits available, including the Child Tax Credit, Earned Income Tax Credit, and American Opportunity Tax Credit.

- Child Tax Credit: This credit provides a direct reduction in your tax bill for each qualifying child under the age of 17.

- Earned Income Tax Credit: This credit is available to low- and moderate-income working individuals and families.

- American Opportunity Tax Credit: This credit helps offset the costs of higher education expenses.

3. Itemize Deductions:

Itemizing deductions involves listing specific expenses on your tax return instead of claiming the standard deduction. This can be beneficial if your itemized deductions exceed the standard deduction.

- Mortgage Interest: Interest paid on your mortgage is tax-deductible, providing a benefit to homeowners.

- Property Taxes: Property taxes paid on your primary residence or vacation home are also deductible.

- Medical Expenses: Certain medical expenses that exceed 7.5% of your adjusted gross income can be deducted.

4. Explore Tax-Free Income Sources:

In addition to reducing your taxable income, you can also explore tax-free income sources. These include:

- Municipal Bonds: Interest earned on municipal bonds is generally tax-free at the federal level.

- Roth IRAs: Contributions to Roth IRAs are made after-tax, but withdrawals in retirement are tax-free.

- Life Insurance: Proceeds from life insurance policies are typically tax-free for beneficiaries.

5. Seek Professional Tax Advice:

Navigating the complexities of the tax code can be challenging. Consider consulting with a qualified tax professional who can help you identify all available deductions, credits, and loopholes that apply to your specific situation.

Remember, this guide provides a general overview of tax-saving strategies. The specific provisions and regulations may vary depending on your circumstances. It's always advisable to refer to the official IRS website or consult with a tax professional for personalized advice.

Earning free returns on your income taxes is not just a dream; it's a reality that you can achieve. By understanding tax loopholes, utilizing strategies, and seeking professional guidance, you can unlock the power of the tax code and save thousands of dollars on your tax bills.

Remember, tax laws are subject to change, so staying informed and adapting your tax-saving strategies accordingly is crucial. With the knowledge and tools provided in this guide, you're well-equipped to embark on a life of financial freedom, starting from the 2024 tax season.

So, mark your calendars, gather your documents, and let's conquer the tax code together. It's time to eliminate the stress and unlock the secrets to a tax-free future.

4.4 out of 5

| Language | : | English |

| File size | : | 1430 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 29 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Robert Page

Robert Page Hakim Saboowala

Hakim Saboowala Janice Morphet

Janice Morphet Rebecca F Pittman

Rebecca F Pittman Roxanne Rustand

Roxanne Rustand Jay Conrad Levinson

Jay Conrad Levinson Diana Stout

Diana Stout Recipes365 Cookbooks

Recipes365 Cookbooks Terrell Clements

Terrell Clements Butch Richards

Butch Richards Raven Coyne

Raven Coyne Marcel Moring

Marcel Moring Carol Olten

Carol Olten Steven F Daniel

Steven F Daniel Ron Roszkiewicz

Ron Roszkiewicz Kathy Kaehler

Kathy Kaehler Brad Free

Brad Free Kamel Daoud

Kamel Daoud Robert Summers

Robert Summers Norman C Mcclelland

Norman C Mcclelland

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jimmy ButlerThe Tool for Assessing Sustainability Advances in Agroecology: A Catalyst for...

Jimmy ButlerThe Tool for Assessing Sustainability Advances in Agroecology: A Catalyst for...

W. Somerset MaughamUnlock the Secrets of Consulting Success with "The Oracle Way To Consulting"

W. Somerset MaughamUnlock the Secrets of Consulting Success with "The Oracle Way To Consulting"

Cason CoxAn Introduction to Urban Development and Management: Unlocking the Secrets of...

Cason CoxAn Introduction to Urban Development and Management: Unlocking the Secrets of... Esteban CoxFollow ·4.8k

Esteban CoxFollow ·4.8k Thomas PowellFollow ·14.5k

Thomas PowellFollow ·14.5k Avery SimmonsFollow ·6.9k

Avery SimmonsFollow ·6.9k Clark CampbellFollow ·7.9k

Clark CampbellFollow ·7.9k James GrayFollow ·17.9k

James GrayFollow ·17.9k Phil FosterFollow ·12.5k

Phil FosterFollow ·12.5k Herman MelvilleFollow ·11.9k

Herman MelvilleFollow ·11.9k Chinua AchebeFollow ·11.5k

Chinua AchebeFollow ·11.5k

Henry Green

Henry GreenCorrosion and Its Consequences for Reinforced Concrete...

Corrosion is a major threat to reinforced...

James Gray

James GrayDiscover the Enigmatic World of Pascin in "Pascin Mega...

Immerse Yourself in the...

George R.R. Martin

George R.R. MartinUnlocking the Power of Nature: Delve into the Bioactive...

In a world increasingly...

Julian Powell

Julian PowellMaster the Art of Apple Watch App Development: A...

Unlock the Potential of Apple Watch Apps In...

Jaylen Mitchell

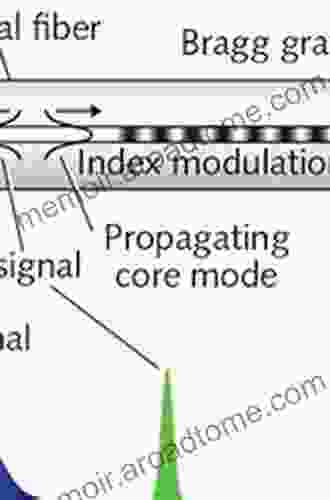

Jaylen MitchellPlastic Optical Fiber Sensors: A Comprehensive Guide to...

In the rapidly evolving landscape of...

Truman Capote

Truman CapoteUnlock the Secrets of Language Creation: Dive into...

The realm of computer science...

4.4 out of 5

| Language | : | English |

| File size | : | 1430 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 29 pages |

| Lending | : | Enabled |